EMA

EMA Bounce Rules

- Prices should be above EMA 200 and above EMA 25 in PT

- The price should Have broken significant Support or Resistance

- In uptrend it should make resitance and in downntrend it should create support

- Check the retracement in PT

- Prices should always be above EMA in PT in Uptrend and below in Downtrend

- Draw a trendline and map EMA or use EMA cross 25 and 50 (as it shows momentum)

- Then look for price crossing EMA

- RSI Should exhibit strength or weakness

Scenario 1: EMA Bounce or Divergence in CT

- Prices are above EMA 200 in PT

- Map Prices with EMA in PT

- Till the prices are above EMA in PT means the stock is trending up

- Map EMA on price in CT

- Wait for prices to go below EMA

- DO NOT TRADE if there is a REGULAR BEARISH DIVERGENCE

- In CT

- Look for Divergence, Divergence can be on or above RSI 40

- Look for small boxes/consolidation

- Candlestick patterns

- EMA Bounce

Scenario 2: Breakout

- Prices are above EMA 200 in PT

- Map Prices with EMA in PT

- Till the prices are above EMA in PT means the stock is trending up

- Map EMA on price in CT

- Wait for price to create a resistance in CT

- DO NOT TRADE if there is a REGULAR BEARISH DIVERGENCE

- In CT - Noise Handling is a must

- EMA 200 + trendline

- SACT

- Price Action

![Scenario 2 CT]()

Scenario 3: Divergence in CT

- Prices are above EMA 200 in PT

- Map Prices with EMA in PT

- Till the prices are above EMA in PT means the stock is trending up

- DO NOT TRADE if there is a REGULAR BEARISH DIVERGENCE

- In CT - wait for divergence

- W pattern

- Break of divergence

- Price Action

Scenario 4: Patterns in CT

- Prices are above/below EMA 200 in PT

- Map Prices with EMA in PT

- Map Prices with EMA in CT

- Pattern break with big candle and volume should be below EMA 200 even if it against trend in CT

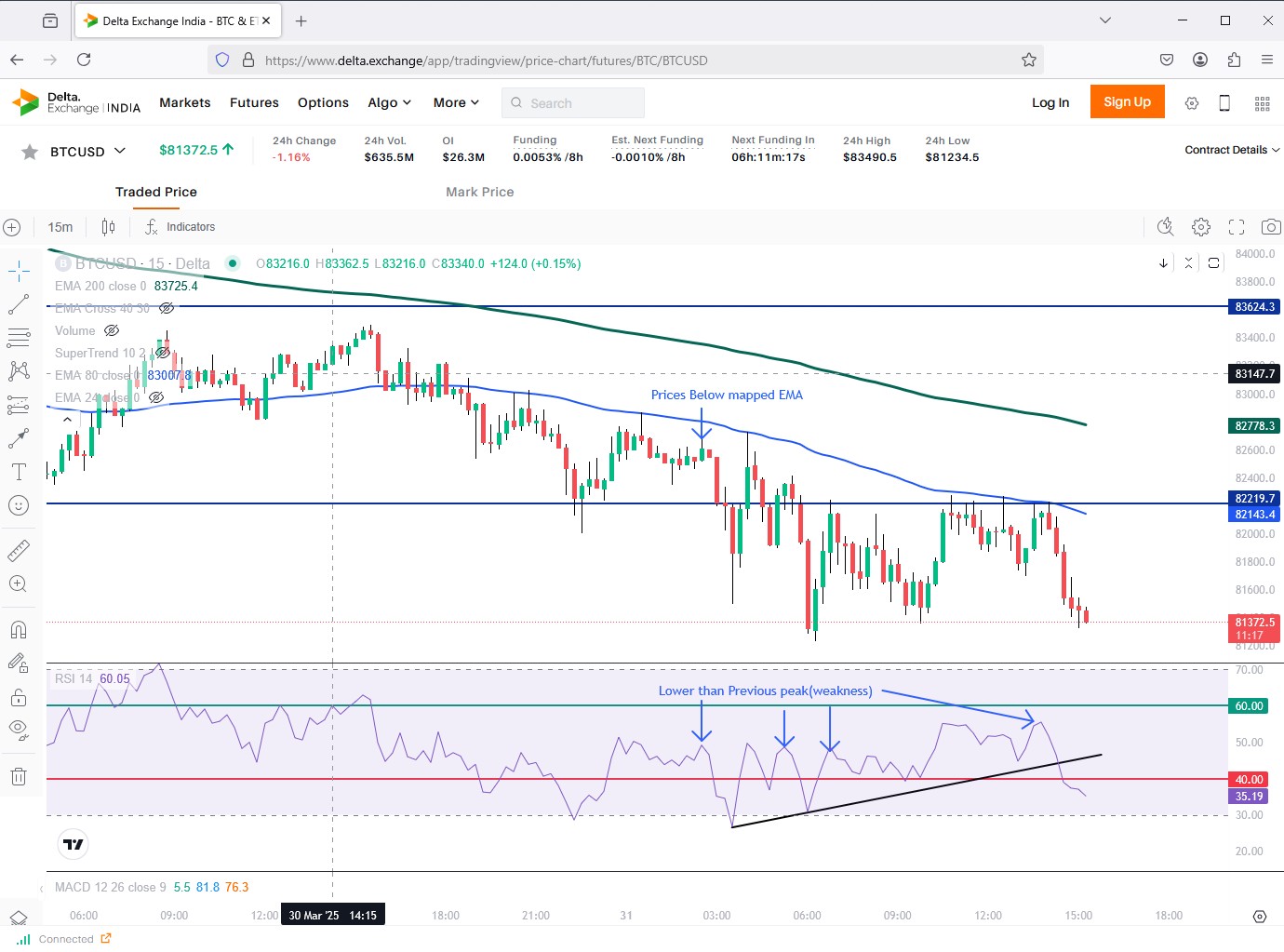

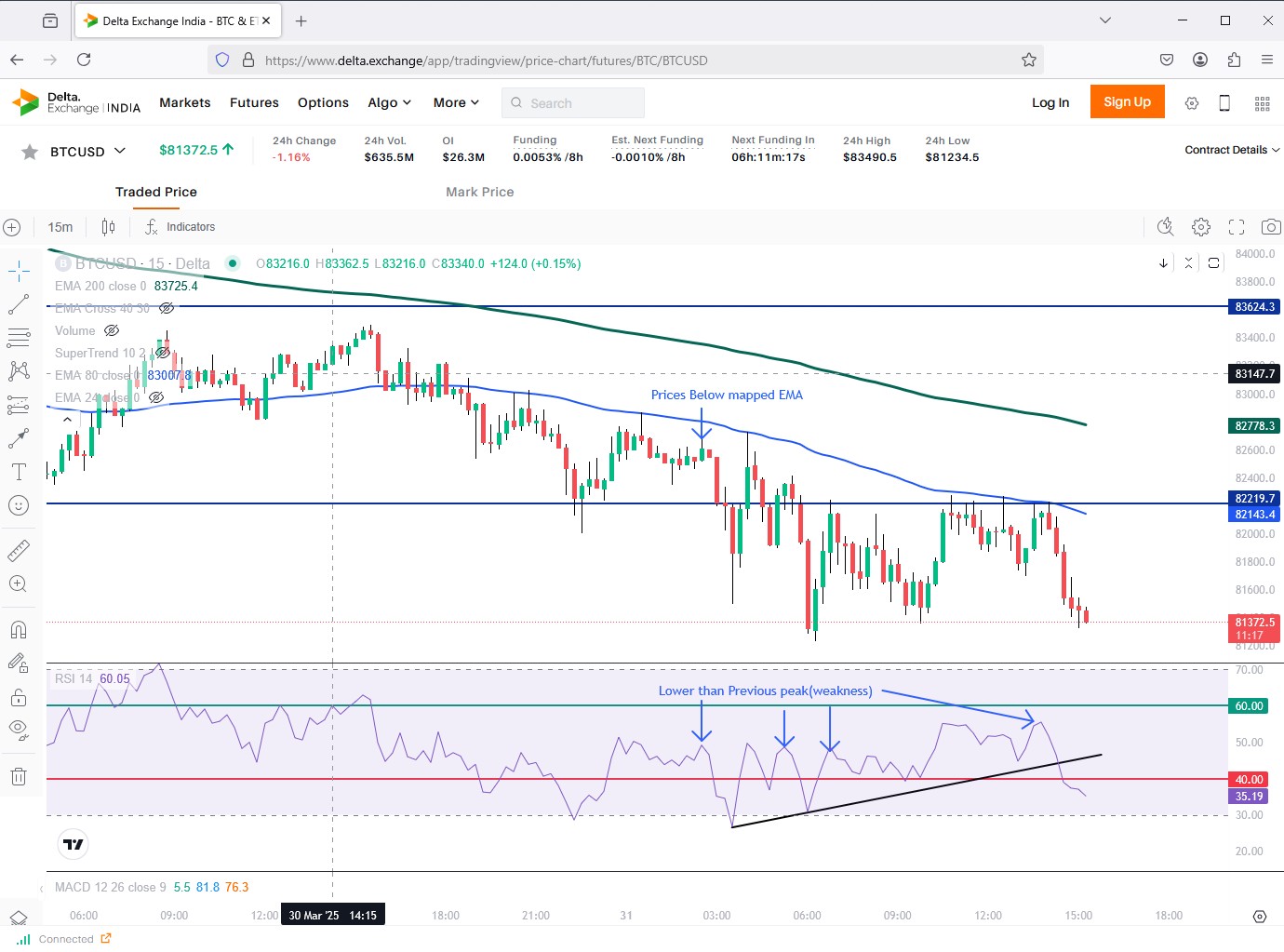

Scenario 4: EMA + RSI

- Prices are above/below EMA 200 in PT

- Prices are below EMA 200 in PT

- Current peak is lower than the previous peak

- In CT

- EMA Bounce

- Candlestick Pattern

- Pattern Below EMA